How to start an LLC for a startup in the USA?

There are a great number of reasons to start your own business. But there are specific requirements that you will have to fulfill before making a start. For instance, if you are in the USA, you will have to read a guide on how to start an LLC for a startup in America. Your own business is the best thing in so many ways. For instance, it gives freedom, the pleasure of building something from scratch, and a chance to make more money. But the process is challenging, and reading a good guide is vital before getting into it.

What are the prerequisites for becoming a good businessman?

If you want to do something on your own, then planning is the first thing because there isn’t any better formula than this. Besides, there are certain qualities that you should have as a businessman. For instance, here are a few questions you must ask as the answer will help determine your area of interest.

- Whether I’m comfortable if there would be any financial instability?

- Are you passionate about the products and services that you will launch?

- Am I ready for long working hours?

- Do you have a business plan?

- Do I have the best team that will help to run my business?

Above all, don’t forget to question your decision-making power. When you run a business, then you constantly need to make decisions, whether they are small or big. But if you are well prepared and have thought about everything, nothing can stop you from going further.

Legal requirements to start a business:

If your research and planning are clear about everything, then the next step is to consider the legal requirement. Generally, people call this less romantic part because it involves so much paperwork and legal activities. Apart from this, at this step, you need to determine the legal structure of your business-like registration, tax code, business license, etc. If you are already in the business world, you must be aware of the state and federal legal requirements. For instance, legally, it’s vital to register an LLC for a startup before getting into any financial activity. But there are many requirements that you will have to consider for an LLC. So, at first, we start with the basic definition.

What is LLC for a startup? A breakdown of the definition:

The LLC stands for limited liability company. An LLC for a startup is a legal entity formed by more than one owner. The primary aim of this legal requirement is to divide responsibilities, debts, assets finance, and liabilities. Apart from this, the LLC separates any business from its owners. For instance:

If anything happens to the business, owners aren’t responsible in their capacity.

The LLC for startups separates businesses from their owners; it’s the most famous business model. Moreover, it’s a simple structure in which business owners pass on profit based on their shares. In addition, a business can add or remove the members anytime according to their deal or requirements.

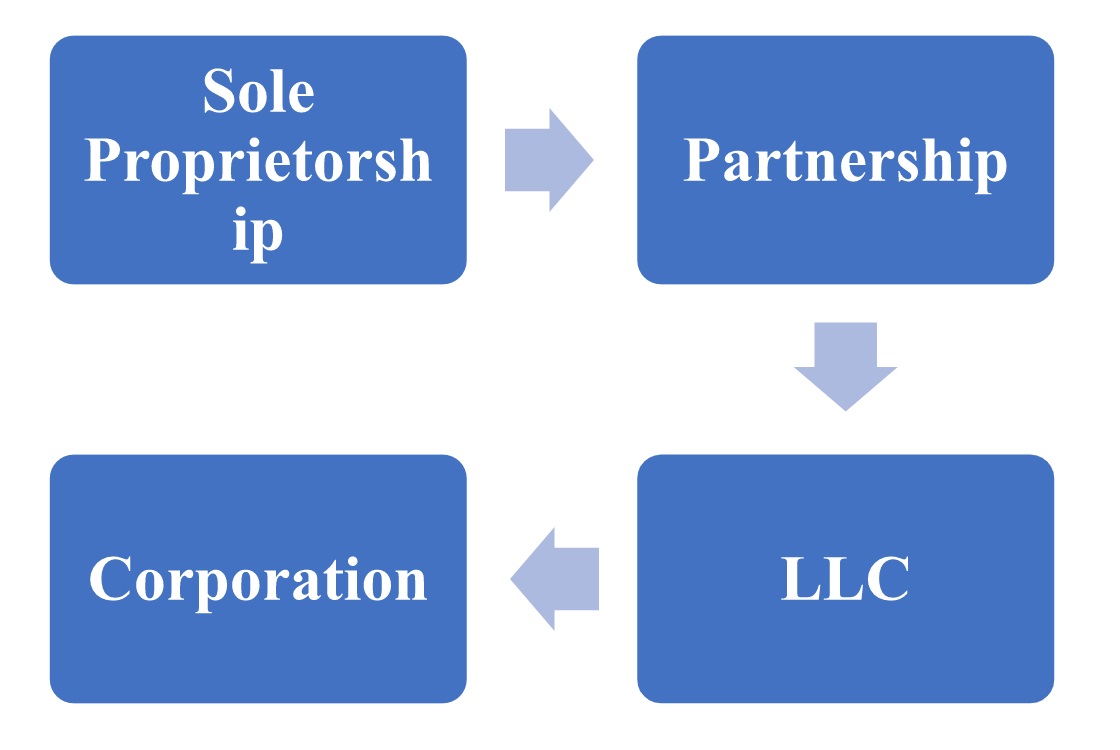

Common business structures in the USA:

It’s crucial to have detailed information before taking a new start. It doesn’t matter if you are starting an LLC for a startup. There are other business structures, and you should know their specifications:

- Sole proprietorship: It’s a business that is run and owned by one person. However, it’s a simple way if you want to start something on your name. For instance, a freelance graphic designing business is an example of this structure.

- Partnership: In this structure, multiple people usually come together to work in a business. The partners contribute a fair share of profits and losses to the company.

- LLC: Limited liability company is more complex than sole proprietorship and partnership. In this, the owners aren’t responsible for losses in their capacity as the business has a separate legal entity.

- Corporation: If you plan to start something on a higher level, then the Corporation structure is best. It’s the most complex type; that’s why it is suggested for more extensive and established companies.

After reading the above definitions, it’s evident that LLC for a startup is the best structure, but the formation time depends upon the state. Usually, the registration period is around 7-10 working days in some states; it can go up to 4-6 weeks.

How can a startup form an LLC in the USA? A complete process:

If you are considering starting a new LLC, there are specific steps you will have to take. But before getting into this, here is the list that entails the best and worst states for startups to form an LLC:

| Worst states to register an LLC | Best states for LLC |

| New Jersey | Wyoming |

| California | Alaska |

| New York | South Dakota |

| Minnesota | Florida |

| Ohio | Montana |

| Maryland | New Hampshire |

| Vermont | Oregon |

| Iowa | Indiana |

These are good and worst states to start an LLC regarding corporate, individual income, and sales tax rates. For instance, you can consider forming an LLC in North Carolina because of the state’s relatively low individual income tax rate and a decent legal environment for businesses. So, if you want to register an LLC, consider this chart and refrain from expensive states. Here are these steps that you must take to register a new LLC in the USA:

Select the state:

If you want to register an LLC for a startup, then it isn’t necessary to be a USA citizen. You can register your business even if you are an outsider. Usually, it’s advised to start an LLC without state taxes; then, you will have to handle only federal taxes. But while choosing the state, consider the chart we listed in the above section. But if you need to start offices and physical presence of business in any specific state, then you need to form an LLC there. However, if the company isn’t physical, you can start from any state. For instance, the few best states are Nevada, Delaware, and Wyoming. Wyoming is a good place that is foreign friendly, has fewer lawyer fees, and no state, federal, and capital gain taxes.

Select the name of your LLC:

The second step is to select the name of your LLC. But before choosing any word, don’t forget to consider the state rules. Here are specific guidelines that you need to take into consideration:

- You can add “LIMITED LIABILITY COMPANY” or LLC in the name

- Don’t include words that can confuse people with state institutes

- If you want to add additional words like “University, Attorney, bank, etc.,” then departments may need other paperwork

Most importantly, don’t forget to check whether the domain name is available or not. We live in a digital world, and taking the business online is vital. So, don’t forget to check for the domain before shortlisting the name.

Gather documents & hire an agent:

A registered agent is a person who manages documents and legal work on your behalf. Many states require hiring an agent, and he should be a resident of the state where you are forming an LLC. Here are documents that you must prepare for forming an LLC for a startup:

| Internal revenue service (IRS) Form SS-4 | The application that you gave for name reservation for LLC | Certificate of organization |

| An operating agreement like business name, address, formation dates | Annual reports that have accurate operational records | Tax registration documents |

| Business license |

You need to prepare documents that entail detailed information about the business. For instance, it generally includes business name, donation record, ownership, strategic management, registered agent, primary business address, etc.

File documents & create an LLC operating agreement:

After completing all steps, filing your documents with the states is next. These papers represent the formation certificates that define the organizational structure of your business. Apart from this, the operating agreement is a must-have that has legal documents. The deal includes the ownership and operating procedures of the LLC. However, it represents that all business owners are on the same page and helps to reduce the risk that can trigger conflict.

Get an EIN & physical mailing address:

Most importantly, you need to get an Employer Identification Number which would work as a tax ID for your business. But remember that you don’t need the social security number or tax identification number to get an EIN. Apart from this, if you are a non-resident, then you can apply by fax or mail. Fax is the fastest available option; by using this, you will receive a reply within one week. In addition, in case of mail, you can fill out, sign, and send the form to the IRS. But the mailing option takes up to 4-5 weeks to get a response.

Moreover, you also need a physical mailing address. However, you can get it by opening a physical office. But if you are a non-resident, you can use services like Earth Class mail or Doola that provide mailing addresses. If you aren’t living in the USA, these services receive mail on your behalf, scan them and deliver packages to your country.

Open a USA bank account:

After completing all requirements, you need to open a bank account to form an LLC for a startup. A USA bank account comes with many benefits like trading in US dollars, boosting savings, higher liquidity, increasing credibility, and many more. But it’s vital to complete certain documents if you are opening a bank account in the USA. Many banks require users to visit a branch to open a new account. However, it’s nearly impossible for non-residents to complete these criteria. But if you are out of the USA, there are also banks where you can open an account by sending online documents.

| Article of organization | USA address that you can get virtually or use the address of your registered agent | Employer identification number |

| Proof of identity like your passport | The operating agreement of the LLC |

The process of opening a new bank account is complicated. But by following the proper steps, you can make it hassle-free.

Get ready for USA tax filing:

The Internal Revenue Service (IRS) defines some rules and regulations that an LLC for a startup needs to fulfill. Here is the chart that contains all information:

| Single member LLC | Form 1040-NR, Form 5472, and Form 1120 |

| Multiple member LLC | File forms like 1040-NR, 5472 and 1065 |

But if you are a non-resident, you can get help from virtual services for legal paperwork. Moreover, if you cannot file form 5472, the penalty is $25,000/return until the form is successfully submitted. So, getting professional help or getting familiar before filing tax returns is vital.

Conclusion:

Forming an LLC for a startup is possible if you live within or outside of the USA. It is one of the best structures to start a new business. For instance, it comes with benefits like limited liability, active ownership, and pass-through income. Apart from this, the terms and conditions of LLC are flexible and straightforward; that’s why most businesses prefer this model. But LLC has investment limitations. So you need to get accurate information and then make a decision that fits your requirements.